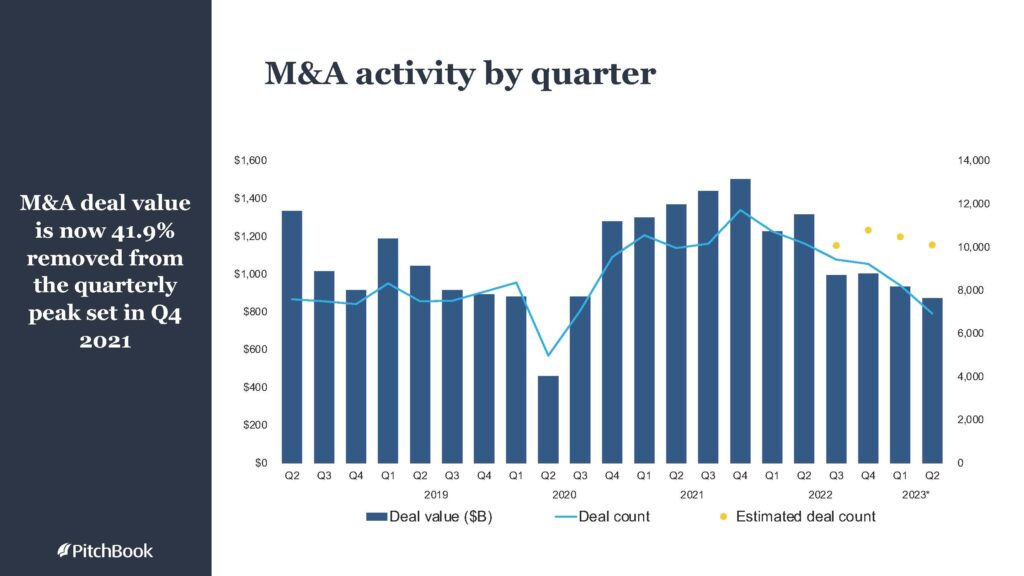

2023 has been a tough slog for Private Equity. M&A deal counts and deal value have dipped dramatically since peaking during Quarter 4 of 2021. “The industry is marking time,” said Tim Clarke, lead PE analyst for the market research firm, Pitchbook, in a recent webinar.

Figure 1 Source: PitchBook Data, Inc. US Private Equity Mid-Year Outlook, September 20, 2023

But the good news is that, in that same webinar, Clarke stated he believes we are seeing the bottom, and many signs are pointing to a PE dealmaking rebound by the end of 2023 or first quarter of 2024.

Private equity firms agree that the rebound is coming, judging from thoughts shared during a recent webinar hosted by Private Equity CXO. Adam Oakley, managing director at Mesirow Investment Banking, stated, “Based on pitch activity and general sentiment, over the next six to twelve months there will be an increase in deal activity.” “There’s entirely too much dry powder out there for this to stay this way forever, and too many businesses that need to be sold,” agreed Lindsay Guzowski, partner at Falcon.

Expense reduction is key to selling high:

In anticipation of the dealmaking rebound, PEs are guiding their portfolio companies to trim fat in the interest of boosting enterprise value and maximizing the return on an eventual deal. “You’re going to see an uptick in sponsors selling to sponsors,” predicted Clarke. “PEs will revert to turnaround specialists, so they’ll have to dust off that playbook.”

Headcount reduction has historically been the de facto strategy for cost control. But many companies have already cut their staff to the bone during this extended dealmaking drought, and they are now scrambling for other strategies to cut costs, grow enterprise value, and boost EBITDA.

Procurement auctions take technology expense reduction to the next level

One bottom-line management strategy that is rarely fully optimized is technology expense reduction. A review of data from nearly two decades of technology procurement activities found that American businesses are spending 79 percent more on technology costs than necessary. Nearly all companies were found to be paying for and using redundant solutions. Often, technology categories have matured and become more competitive in the months and years since contracts were last negotiated. 60 percent of companies fail to effectively manage auto-renew contracts, resulting in spending on products and services that are no longer in use. Factors like this contribute to a massive opportunity for organizations to lower expenses in cloud and data services, CRM, billing software, network storage, telecommunications, business process outsourcing, data center technology, and other technology categories.

The best way for companies to reduce technology expenses is through procurement auctions. Our data shows that auctions are more than twice as effective for driving down expenses as traditional direct negotiation. What makes procurement auctions such a powerful technique? Human beings are hard-wired to compete. A standard two-week auction involving a handful of suppliers often produces hundreds of bids, typically concluding in a frenzy with dozens of bids entered in the final hours. Procurement auctions create a competitive market environment among suppliers as they vie to win an enterprise’s business. Participating suppliers get real-time feedback on how they rank each time a bid is entered, triggering their impulse to respond with a lower bid. This competitive spirit naturally compels suppliers to drive down costs well below list prices.

Now is the time to prepare for the PE dealmaking rebound

The consensus is that the exit slump is coming to an end soon. Private Equity is tightening up the balance sheets for their portfolio companies in anticipation of the rebound. Through advanced techniques like procurement auctions, technology expenses can be reduced by over 40 percent, saving millions of dollars and boosting enterprise value. Cost reduction at this scale can grow EBITDA by as much as 10 percent and can significantly improve exit value.

For more information visit www.aiq.co.

About AIQ:

For over 20 years, the AIQ team has helped clients increase their enterprise value and operating cash by materially reducing IT costs. AIQ is backed by Boston-based private equity firm Copley Equity Partners. AIQ specializes in creating industry-leading savings of technology-centric IT services in over a hundred categories, such as cloud, SaaS, digitization, and big data, through the application of its unique tools, expertise, and business processes. Its patented technology and business process platform ensures maximum savings for clients, while measurably improving quality and service levels from IT suppliers. https://www.aiq.co/

About Copley Equity Partners:

Established in 2012, Copley is a private investment firm with offices in Denver and Boston. Copley partners with growing, lower-middle market private companies. The firm invests out of an evergreen, single-family office capital base and is comfortable in both majority and minority ownership positions. Copley’s patient and flexible capital base allows the firm to provide each portfolio company significant support post investment. www.copleyequity.com.

Media Contact:

Contact:

Glenn Goldberg

Parallel Communications, Inc.

X: @Parallel_PR

516-776-3282

About The Author

Blake Wetzel began his career as an FP&A executive with Qwest Communications/CenturyLink. He is now CEO of AuctionIQ (AIQ), a recognized leader in procurement consulting and e-auctions. Blake Wetzel LinkedIn