ABOUT AIQ

For over 20 years, the AIQ team has helped clients increase their enterprise value and operating cash by materially reducing IT costs. AIQ is backed by Boston-based private equity firm Copley Equity Partners. AIQ specializes in creating industry-leading savings of technology-centric IT services in over a hundred categories, such as cloud, SaaS, digitization, and big data, through the application of its unique tools, expertise, and business processes. Its patented technology and business process platform ensures maximum savings for clients, while measurably improving quality and service levels from IT suppliers.

ABOUT COPLEY

EQUITY PARTNERS:

WHAT DRIVES AIQ

AIQ helps replace doubt with certainty by reducing risks involving security; risks of paying too much; and risks which arise from operating inefficient and hard to manage networks.

Goal

AIQ helps replace doubt with certainty by reducing risks involving security; risks of paying too much; and risks which arise from operating inefficient and hard to manage networks.

Focus

Our consultants are focused on increasing our client’s leverage and maximizing the competition to deliver quick and meaningful results.

Commitment

We establish an invaluable relationship with our clients that provides compelling, mutually profitable, and otherwise unobtainable results.

We Get IT

As one client told us, “IT and Telecom departments plan their strategies on a calendar, but upper management measures timelines with a stopwatch.”

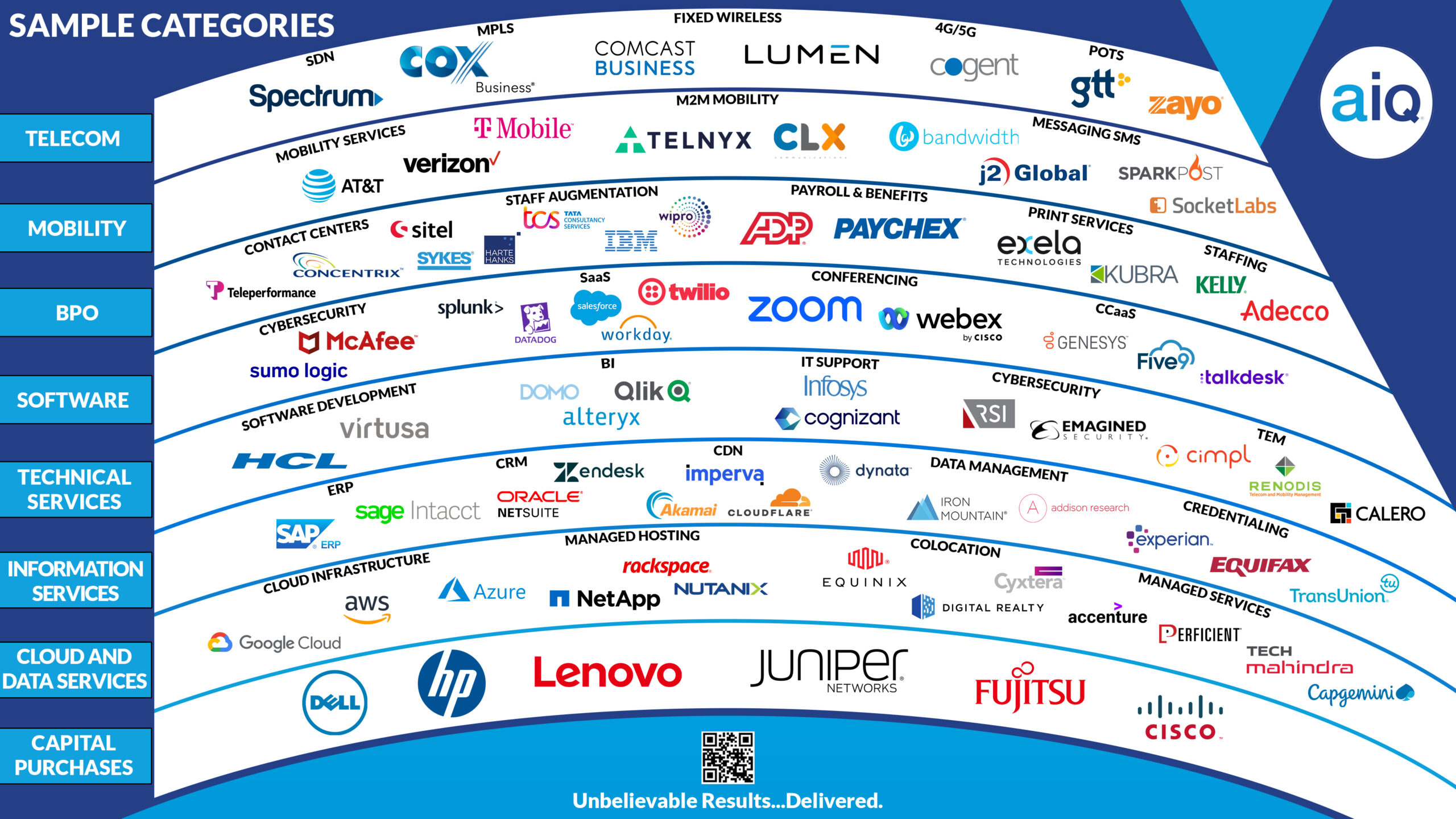

REPRESENTATION OF THE CATEGORIES AIQ SERVICES:

AIQ EXPLAINED

AIQ helps clients perform complex telecommunications network analysis & IT Services, inventories and contract negotiations. As a result, Clients better understand their network & IT Service costs and inventory so they can more effectively manage the cost. For 30 years, AIQ has provided the “IQ” necessary for Fortune 500 companies and other global enterprises to improve their security while increasing their internal rate of return while liberating capital. Clients use the resulting savings to fund improved services and infrastructure then return increased profits to the business.

AIQ has advised clients in global sourcing, development, and design projects, working with teams composed of executives, legal, professional and technical experts. In this role AIQ makes domestic and global in-country sourcing and cost reduction easy for the client, while typically producing savings of around 50%.

Our clients have the unique opportunity to purchase precisely what they desire from the suppliers of their choice, all at the most favorable market rates. The cost savings generated by this project will empower our customers to preserve their valuable personnel, boost company profits, and allocate budgetary resources for departments to acquire new goods or services.